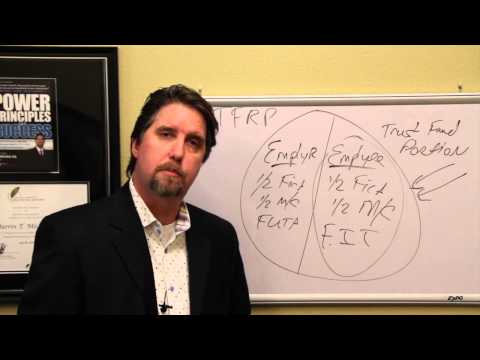

I wanted to take some time today to explain something called the trust fund recovery penalty. It's kind of a silly name because it's actually not a penalty at all. It represents unpaid payroll taxes that an employer is responsible to hold in trust for the US government. To make matters worse, it used to be called the one hundred percent penalty, which led people to believe that there was no penalty. In reality, it is a penalty of one hundred percent of the tax company interest owed on top of what they owe in terms of payroll taxes. Now, let's take a look here on the board and I'll explain it a little bit better. Okay, so we have the trust fund recovery penalty (TFRP) for short. What we have here is what I call the payroll tax pod. It's the only way I can figure out how to explain this to people in simple and concise language that they would understand. As you can see here, I can't draw circles very well. But, we have a larger half of this pie that represents the employee's share of payroll taxes. On the other side, we have the employer's contributions. I apologize for misspelling those things. So, let's break it down. On the employee's side, we have half of FICA (Federal Insurance Contributions Act), half of Medicare, and half of the federal unemployment tax. Additionally, we have the federal income tax which is automatically withheld from their paycheck. This is something that the employer is supposed to do for the benefit of the US government and the employee. On the employer's side, we have the trust fund portion, which is the larger half of the pie. Again, it is called the trust fund portion because the employer is supposed to hold that...

Award-winning PDF software

Trust Fund Recovery penalty Form: What You Should Know

How it works — Anderson & Jade Sep 25, 2025 — Paying the Trust Fund Recovery Penalty to the IRS If you are a qualified taxpayer, you can settle a judgment against your employer for the Trust Fund Recovery Penalty at the federal level of tax (currently at 35%) — Anderson & Jade The trust fund penalty is levied at a rate of 8.35% (i.e. 2,084 for each employee who is covered by a TENANT CONTRACT) up to a maximum rate of 18%. However, the IRS can tax the payment if you fail to deduct the penalty from your individual federal gross income. Why the Trust Fund Recovery Penalty exists — In order to make it as easy as possible for employers, the IRS is allowing employers to pay the trust fund penalty to the IRS for workers on their payroll who failed to withhold the full amount under the requirements of the federal law. The trust fund penalty is levied at a rate of 8.35% (i.e. 2,084 per individual employee) up to a maximum rate of 18%.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4180, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4180 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4180 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4180 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Trust Fund Recovery penalty